AI Models to Combat Financial Fraud

Prevent fraud in real time to increase customer trust, decrease operational costs and detect fraudulent patterns at scale using artificial intelligence.

Fraud Prediction AI Accelerator

Fraud prediction in credit and debit cards is an important area of research for financial institutions and companies that issue credit and debit cards. Predicting fraud involves analyzing transaction patterns and identifying suspicious activities in real-time. Fraud Prediction Accelerator is a tool designed to help financial institutions and companies that issue credit and debit cards to detect and prevent fraud in real time.

Boolean’s Fraud Prediction AI Accelerator Includes

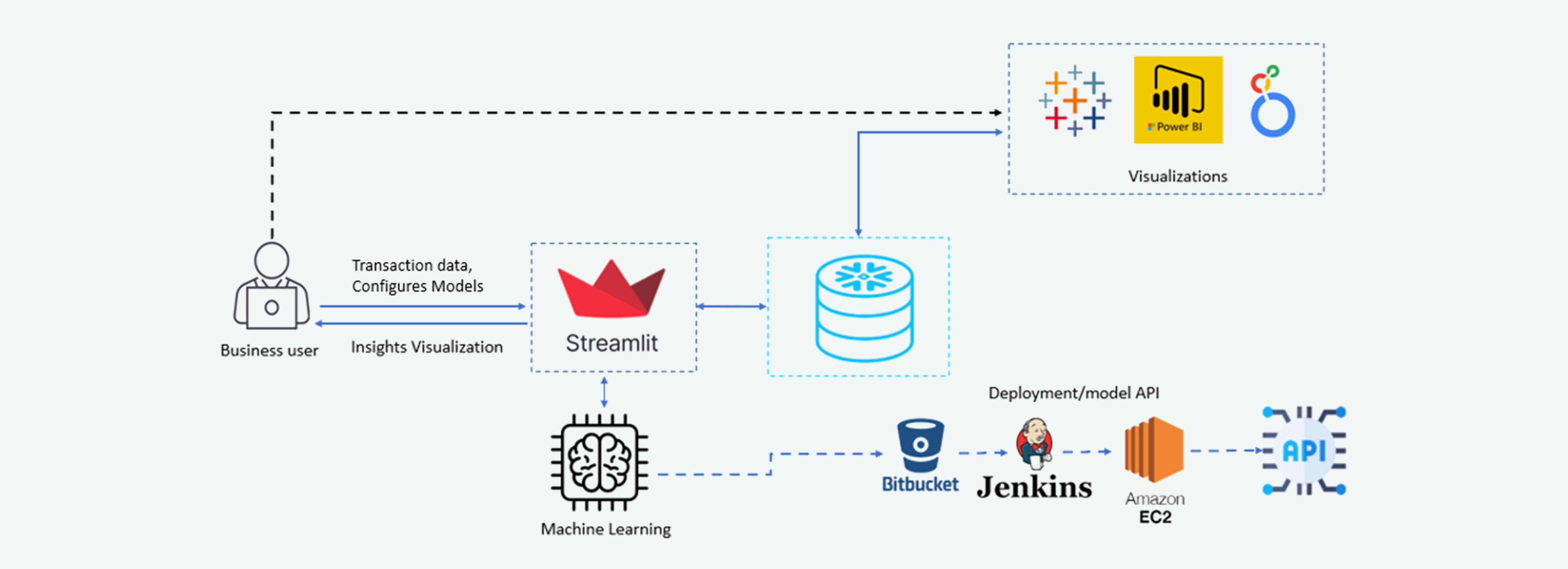

Data Pipelines to injest data from sources to Snowflake

ML and AI models for Fraud Prediction

Dashboards in PowerBI and Streamlit to observe and monitor the Fraud Prediction

A fraud prediction accelerator is a tool or technology that helps financial institutions and credit/debit card companies detect and prevent fraud more effectively

The accelerator typically features advanced algorithms and machine learning models that analyze patterns in transactions and customer behavior to identify potential fraud

Real-time monitoring is a key feature of fraud prediction accelerators, allowing suspicious activities to be flagged and addressed immediately

The use of fraud prediction accelerators can help financial institutions and card companies reduce losses due to fraud, as well as improve customer confidence in their services

Credit Card Fraud Detection

Insurance Claims Fraud Detection

E-commerce Fraud Detection

E-commerce Fraud Detection

Healthcare Fraud Detection

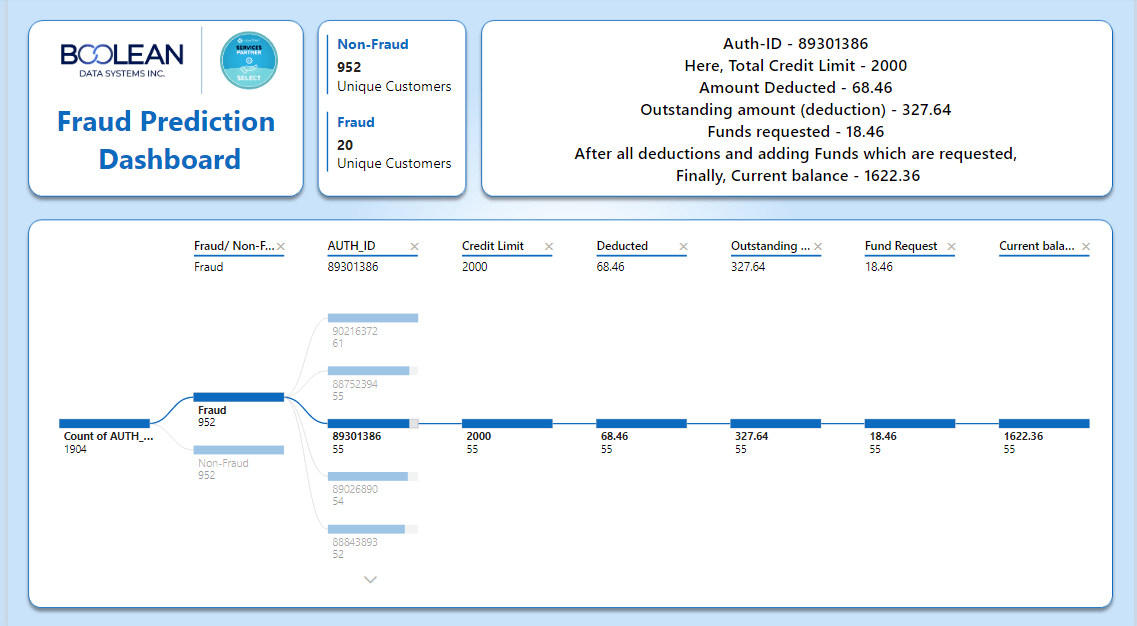

Fraud Detection Dashboard

This report shows all the transactions, deductions, and funds which are added to each and every Customer.

1. Multi Card:

This tile shows the Total unique transactions of each Fraudulent and Non-Fraudulent Customer.

2. Tile:

Here we can know the information regarding the customer ID, his Total Credit limit, all his deductions, funds requested, and final current balance.

3. Decomposition Tree:

This visual represents is a breakdown of all transactions into two categories: Fraudulent and Non-Fraudulent. We are conducting a comprehensive review of each customer’s transactions, including their credit limit, deductions, outstanding balances, fund requests, and current balances. The visual also shows the number of times a particular customer’s ID appears below that Customer ID in the dataset.

Industry Insights

Video

Architecture Diagram of Fraud Prediction AI Accelerator

Get Started with Fraud Prediction AI Accelerator

Learn how Boolean can help you reduce costs and optimise performance while ensuring control and compliance.

Request For Demo

Get Started with the Fraud prediction AI Accelerator

About Boolean Data

Systems

Boolean Data Systems is a Snowflake Select Services partner that implements solutions on cloud platforms. we help enterprises make better business decisions with data and solve real-world business analytics and data problems.

Services and

Offerings

Solutions &

Accelerators

Global

Head Quarters

1255 Peachtree Parkway, Suite #4204, Alpharetta, GA 30041, USA.

Ph. : +1 678-261-8899

Fax : (470) 560-3866